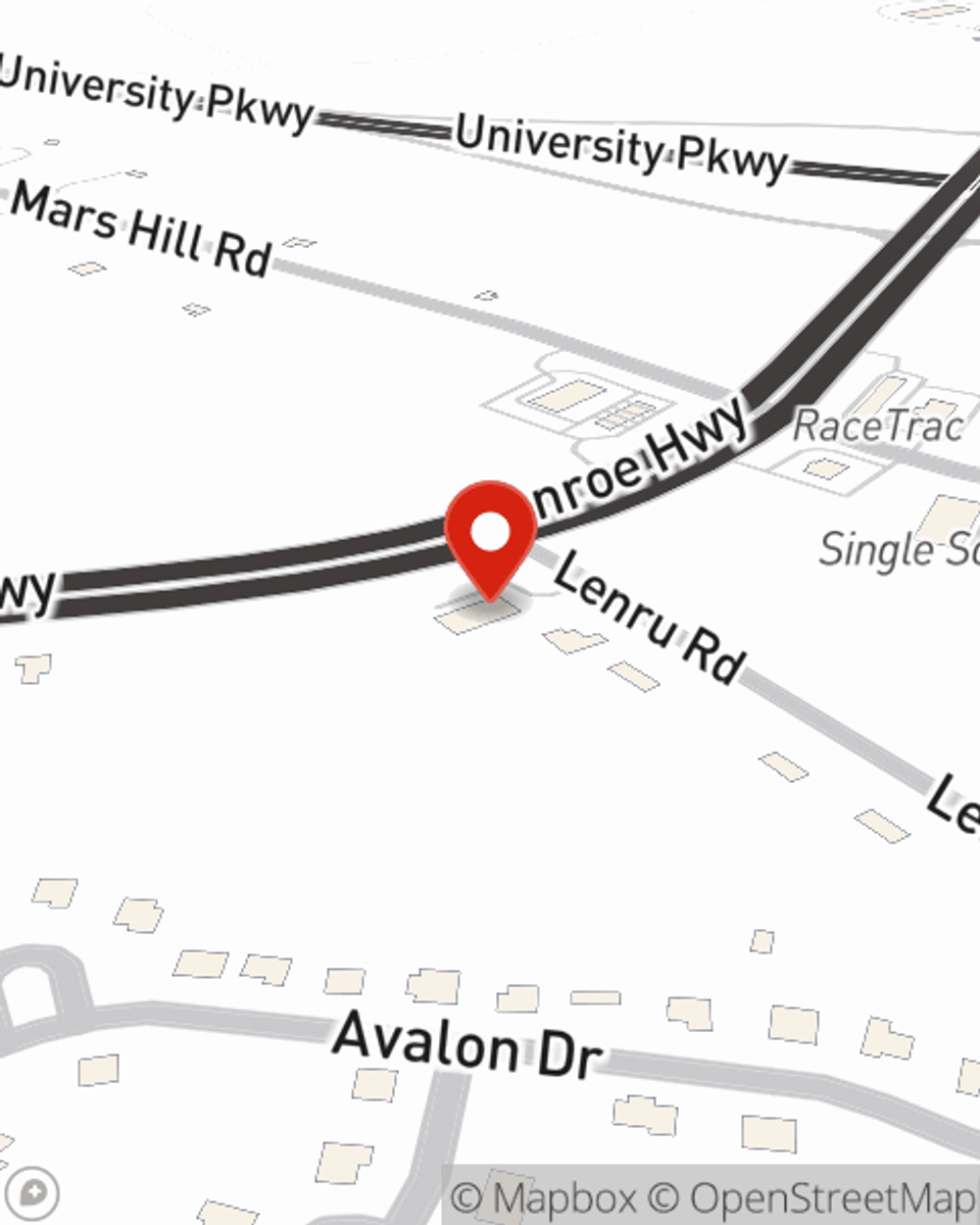

Renters Insurance in and around Bogart

Looking for renters insurance in Bogart?

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Bogart

- Statham

- Monroe

- Athens

- Bethlehem

- Watkinsville

- Winder

- Grayson

- Loganville

- Jefferson

- Auburn

Home Sweet Home Starts With State Farm

Trying to sift through providers and coverage options on top of your pickleball league, work and keeping up with friends, can be time consuming. But your belongings in your rented townhome may need the terrific coverage that State Farm provides. So when mishaps occur, your electronics, videogame systems and clothing have protection.

Looking for renters insurance in Bogart?

Coverage for what's yours, in your rented home

Protect Your Home Sweet Rental Home

You may be wondering: Is having renters insurance beneficial? Imagine for a minute the cost of replacing your personal property, or even just a few of your high-value items. With a State Farm renters policy in your corner, you won't be slowed down by windstorms or tornadoes. But that's not all renters insurance can do for you. It extends beyond your rental space, covering personal items you've stored in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. As more of your life is online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent Brian Gibbs can help you add identity theft coverage with monitoring alerts and providing support.

As a dependable provider of renters insurance in Bogart, GA, State Farm strives to keep your home safe. Call State Farm agent Brian Gibbs today for a free quote on a renters policy.

Have More Questions About Renters Insurance?

Call Brian at (770) 725-7000 or visit our FAQ page.

Simple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Brian Gibbs

State Farm® Insurance AgentSimple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.